A lot of self-employed people who received CERB benefits were not qualified and will have to pay back the up to $14,000 in benefits that they received. The confusion lies in whether the business income qualification is gross or net income. Taxes and terminology are confusing at best. It is very clear that the communications …

Things are entering the new reality phase The CRA is resuming a full range of audit work and adapting practices to address to the new C-19 world. CRA is paying attention to taxpayer’s need to advance their work on – in progress audits. To prioritize CRA is focusing on the higher dollar audits first, files …

The Rules Shall Set You Free The first order of business when embarking on a paperless office is to establish your file naming conventions. This is the single most important step in getting off on the right foot when going paperless in the office. These protocols must be in place, otherwise it’s the wild west. …

Do you maintain a paper filing system as well as a digital filing system within your office? You are not alone, most offices receive and create paper + digital materials. Unfortunately, boxes of paper records continue to invade the office. How does this happen? We just like our paper – it takes some getting …

Tax Court of Canada Update The tax court does not know when it will open. The earliest they will know will be sometime in June. It will be 90 days from knowing to actually restarting court cases. The first date that they may know when they can restart is May 24th. Motions will be heard …

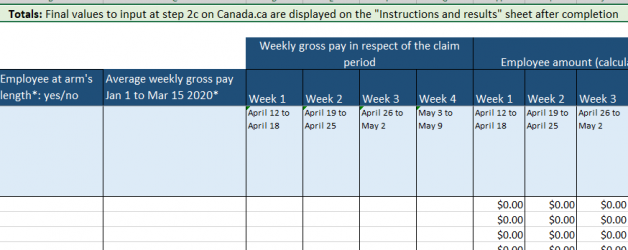

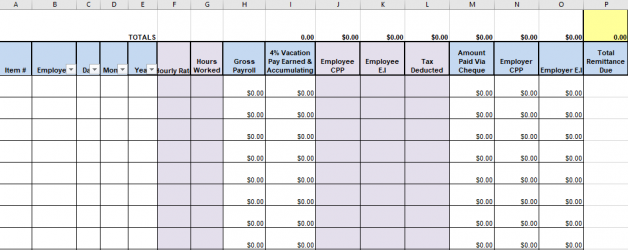

The first thing you need to do is have all your payroll data accessible If you cannot sort your payroll data by employee, dates and amounts you need – this must be set up. If you are using a commercial payroll program you may not have access to the data that you want. There is …

Tips for preparing a CEWS Claim The second claim period for the CEWS ended on May 9. The wage subsidy program was rolled out quickly and an electronic working paper download was provided to professionals and business owners to assist in preparing correct claims. Since many business owners have had additional planning time on their …

Supreme Court of Canada rules derivatives contract to be a hedge in the tax case of James MacDonald vs The Queen. The Supreme Court of Canada (SCC) has dismissed an appeal in the case of a taxpayer who argued that payments of approximately $10 million he made as part of a derivatives contract were losses …

It has been more than one moon phase since the effects of COVID-19 began to take their toll on individuals and businesses. As the weeks wear on, the realities of change are beginning to sink in. The COVID crisis has wiped out or wounded business cash flows. Certain business operations have had to bear the …