The first thing you need to do is have all your payroll data accessible

If you cannot sort your payroll data by employee, dates and amounts you need – this must be set up. If you are using a commercial payroll program you may not have access to the data that you want. There is no magic bullet that will generate your claim – it must be calculated using accurate data. A breakdown of your payroll data in a spreadsheet is the audit ready way. Once you have this foundation of payroll data you can start a claim.

- Open the CEWS Calculator provided by CRA

- Enable editing

- Select your claim period

- Do you issue weekly payments to your employees? If you do, you may want to complete batch calculations.

- Batch Calculations are optional and require you access weekly payroll figures.

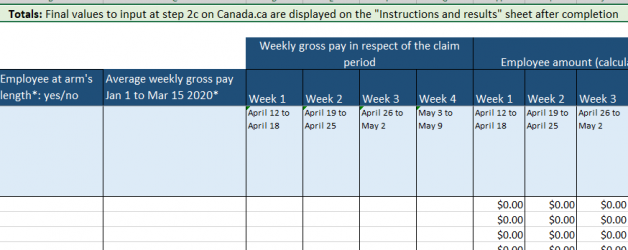

- Batch Calculations are one approach to processing a CEWS claim. Each batch will include total remuneration during a 4 week claim period.

- I do not recommend using the batch calculation method – choose the Weekly or Bi-Weekly payment sheets provided, tabulate eligible employees and create an audit trail.

- Add each eligible employee onto your payment sheet. These entries will match your payroll ledger.

- Your payment periods and the claim periods may not align perfectly.

- If you have a pay period that begins in one claim period and ends in the next claim period you have a couple of options: You can cut it in ½ , apportion the pay exactly by the week or claim the full amount of the pay in the claim period in which the payment was made.

- It is easier to claim the full pay in the claim period in which it was actually paid vs splitting.

- Pick a method of reconciliation and stick to it. If you apportion the pay by the week then continue doing it this way for the entire program. If you claim the full pay in the period in which it was paid continue to do this for the entire program. Be consistent

- You should not have more than 2 biweekly pays per employee included in a claim period.

- When your claim sheets are completed, login to your CRA business account and file your claim online.

- Do not claim the 10% wage subsidy. Keep your claim simple.

- If your employees are not working and have been furloughed but still receive their regular pay you may increase your claim by employer CPP and EI amounts.

- The Maximum benefit per employee is $847 per week or 3,388 per 4 week claim period.

- Keep a copy of your claim records, claim confirmation sheet and your payroll data ready for review if required.