Tips for preparing a CEWS Claim

The second claim period for the CEWS ended on May 9. The wage subsidy program was rolled out quickly and an electronic working paper download was provided to professionals and business owners to assist in preparing correct claims. Since many business owners have had additional planning time on their hands, it seems most have managed to file their claims. The processing of claims has been equally efficient with deposits directly to business accounts within days. This is a well laid out and executed program.

If you are a business owner who has not made a claim yet, here are some tips to get you set on the right track:

- Payroll data needs to be accessible by date range, pay period, employees, remuneration amounts and deductions.

- The best way to chart your payroll data is in a spreadsheet.

- There is no quicker, easier way to do this.

- CEWS claim periods will not likely match your pay periods.

- You will need to make some detailed calculations or assumptions to deal with partial pay periods included in a claim period.

- The higher the payroll the greater the risk in making an error in your claim

- Do not claim the 10% wage subsidy if you are claiming the 75% CEWS, it just makes more calculations.

- You need to have patience to set up a payroll ledger that will allow you unrestricted access to all your data to assist in preparing a claim.

- As a result of COVID-19, year end payroll account reconciliations are going to be needed by more people.

- Set up your payroll ledger now and get it over with.

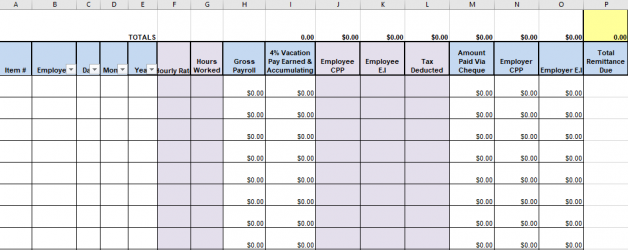

The government made an excellent CEWS calculation spreadsheet available to prepare claims (link below). This sheet requires that you input specific payroll data from your business. If you would like to set up a payroll ledger spreadsheet to capture your business payroll data, contact us and we can send you a template.

Click here to go to learn more about Emergency Wage Subsidy